The Internal Revenue Service announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2021-45 provides details about these annual adjustments.

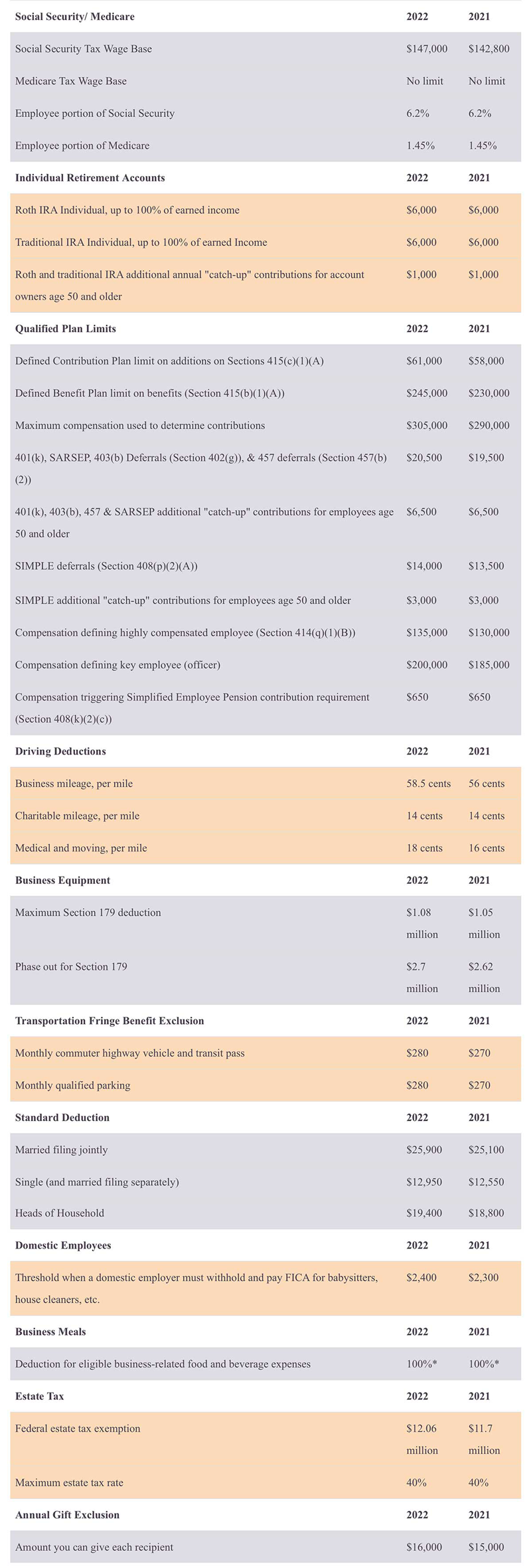

The following table provides some important federal tax information for 2022, as compared with 2021. Some of the dollar amounts are unchanged and some changed only slightly due to inflation.

* Provided by restaurants. This is part of the Consolidated Appropriations Act, signed into law on December 27, 2020. The 100% deduction is scheduled to return to 50% in 2023, unless Congress acts to extend it.

The tax year 2022 adjustments described above generally apply to tax returns filed in 2023.

If you have any questions about these changes, contact your tax advisor at LvHJ. We are happy to help in any way.