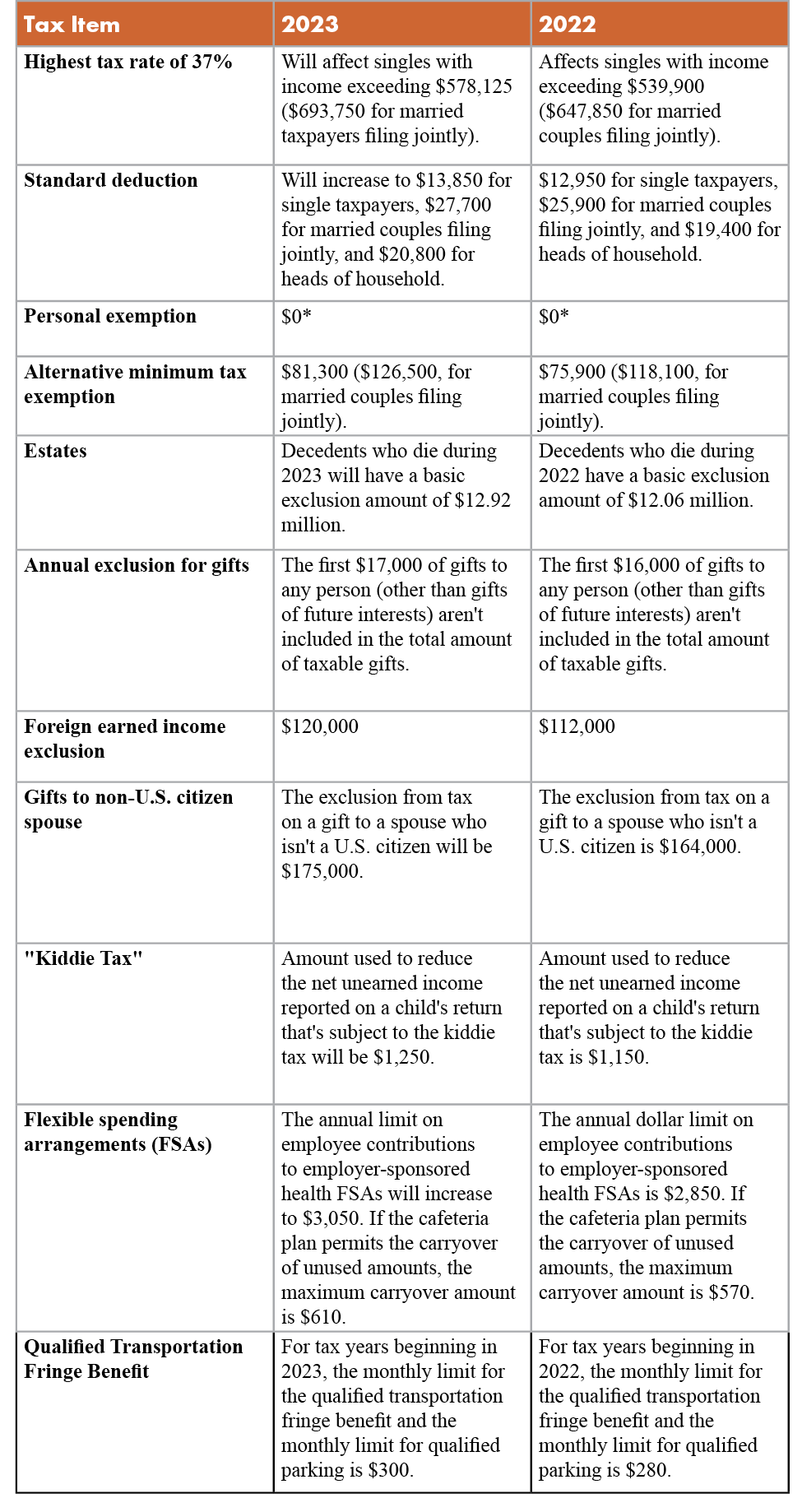

Because inflation is high, many IRS inflation adjustments for 2023 will change more than they have in recent years. In the IRS Revenue Procedure 2022-38, it details these amounts. The following chart shows how these adjustments compare to amounts for 2022. Refer to these changes for your individual tax planning.

In addition, the Social Security Administration announced that the Social Security wage base (the amount of earnings subject to taxation) will increase to $160,200 in 2023 (up from $147,000 in 2022). This threshold means that if you earn more than $160,200 in 2023, you won’t pay Social Security tax on the amount above that.

* The personal exemption was eliminated by the Tax Cuts and Jobs Act from 2018 to 2025.

If you have questions about deductions and exemptions for 2022 taxes or for 2023 tax planning, contact us at LvHJ.

Next: Individual Tax Planning Updates