Developers in underserved communities will have access to federal passthrough state grants to lower installation costs of broadband internet in new developments and existing multi-family properties. The grants will help finance delivery of free Wi-Fi access to residents.

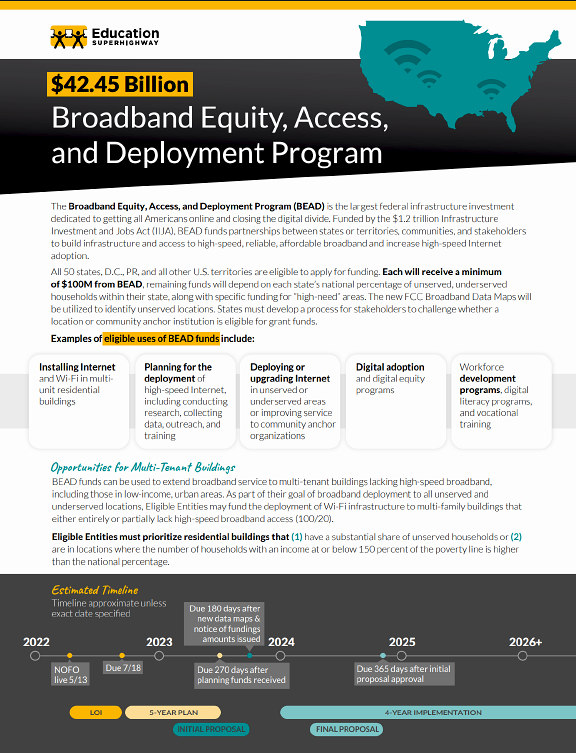

Part of the $1.2 trillion Infrastructure Investment and Jobs Act (IIJA), the Broadband Equity, Access, and Deployment Program (BEAD) offers $100 million (minimum) to each state for the specific use of giving underserved communities access to high-speed internet. States are in the application phase now to receive the funds, with funds available to entities sometime in 2024.

By combining state or local funding with competitive grant funding, landlords could dramatically lower their monthly broadband costs, according to a San Francisco, California-based nonprofit EducationSuperHighway. In cooperation with the City of Oakland, CA and an internet service provider, the nonprofit has already launched a pilot broadband installation program, completing five low-income buildings through mid-2021:

“Our objective is to connect over 14,000 households and 40,000 people by deploying free apartment Wi-Fi in the 800+ buildings in Oakland where more than 25% of the households do not have a home broadband connection.”

EducationSuperHighway is using the pilot program to create a playbook for government agencies, affordable housing developers, and multi-family property owners to implement the free service to residents with limited out-of-pocket costs per property. In addition, EducationSuperHighway has been concentrating on launching outreach campaigns to educate policymakers of various state and local governmental agencies on the importance of including affordability-focused programs in the use of BEAD.

Who qualifies?

In order to be eligible for future funding, developers or managers must prioritize residential buildings that have a substantial portion of unserved households or are in locations where the number of households with incomes below 150% of the poverty line exceeds the national average. They would apply for grants through their state when the funding becomes available. Since the states are formulating their 5-year plan for BEAD, more detailed guidance on the eligibility requirements may be available in later 2023.

For more information about establishing and executing a free apartment Wi-Fi program in your city or state, download the high-level PDF and express your interest by filling out the building registration form on EducationSuperHighway’s website. EducationSuperHighway will use this information in discussions with policymakers to stress the importance of including MDUs in their BEAD plans.

DEA Broadband Grant

In addition to BEAD, another federal funding for increasing broadband access is from Digital Equity Act (DEA). Nonprofit organizations can apply for the DEA grants in 2024 to achieve digital equity, promote digital inclusion activities and spur greater broadband adoption among covered populations. Watch for details from your state’s designated administering entity, which will be published in a list by the National Telecommunications and Information Administration (NTIA).

DEA grants apply to populations including aging individuals, veterans, individuals with disabilities, individuals with a language barrier, members of a racial or ethnic minority and rural residents.

This is an exciting opportunity for developers and managers to apply for government funding to provide better standards of living for underserved communities, while also making their properties more attractive and sustainable.

If you have any questions about grant reporting or accounting best practices, please contact our affordable housing CPAs by emailing us at info@lvhj.com.

Visit our website to learn more about LvHJ’s affordable housing experience.

Source: NDIA